What Is Digital Banking? Explaining What Makes It Different

It's no surprise that banking has also undergone a significant transformation. Digital banking has emerged as a prominent force in the financial industry, reshaping how we manage our finances, conduct transactions, and interact with financial institutions.

But what exactly is digital banking, and what sets it apart from traditional banking? Let's delve into what digital banking means to understand its intricacies and explore what makes it distinct.

What is Digital Banking?

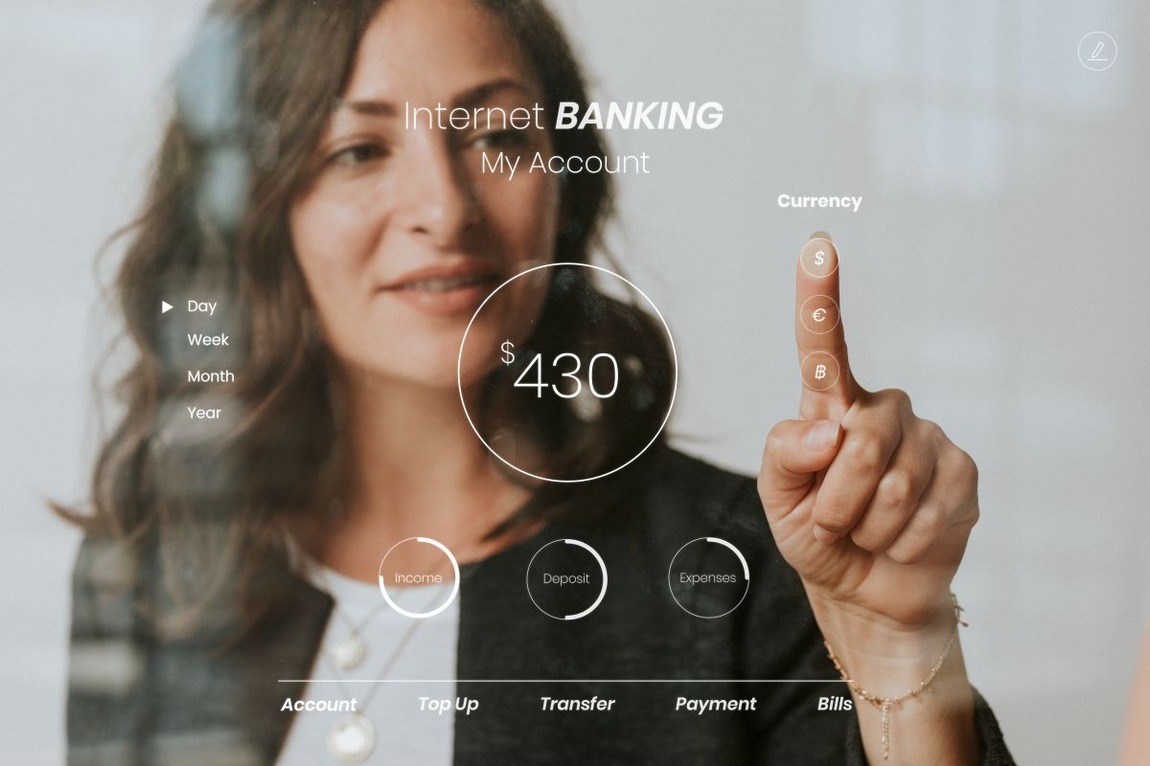

Digital banking, also known as online banking or internet banking, refers to the provision of banking services through digital channels such as websites, mobile banking apps, and other electronic devices. It encompasses a wide range of services traditionally offered by brick-and-mortar banks, including account management, fund transfers, bill payments, loan applications, and more.

Online banking allows private and corporate clients to perform various banking activities conveniently and securely without the need to visit a physical bank branch. With digital banking services available 24/7, customers can access their accounts and conduct transactions anytime, anywhere, as long as they have an internet connection. This eliminates the constraints of traditional banking hours and geographical limitations, empowering customers to manage their finances on their own terms.

Digital banking platforms are designed with user-friendly interfaces and intuitive features to streamline the banking experience. Whether it's checking account balances, transferring funds, or setting up automated payments, customers can navigate through the various functions effortlessly.

Moreover, digital banking often offers personalized services, such as financial insights and customized recommendations, tailored to individual preferences and financial goals, thereby enhancing overall customer satisfaction.

Difference Between Traditional vs. Digital Bank

To help you better understand what is a digital bank, it's best to compare its features with a traditional brick-and-mortar bank. While both traditional and digital banks serve the fundamental purpose of providing financial services, they differ significantly in their approach, operations, and customer interactions. Let's delve into the key differences between these two banking models.

Branch Presence

- Traditional Banks

Traditional banks typically operate through physical branches, offering face-to-face interactions with customers. These branches serve as central hubs for various banking activities, including account opening, loan applications, and customer service inquiries. Customers often rely on branch visits for banking transactions and assistance. - Digital Banks

In contrast, digital banks operate primarily online, without physical branch networks. They leverage digital channels such as websites and mobile apps to deliver banking services. Online banks prioritize convenience and accessibility, enabling customers to manage their finances remotely without the need for branch visits. While some digital banks may offer limited physical touchpoints or partner with existing networks for certain services, their focus remains on digital-first interactions.

Accessibility and Convenience

- Traditional Banks

Traditional banks may have limitations in terms of accessibility, as customers need to visit physical branches during operating hours for many banking activities. While they often provide additional services such as ATMs and telephone banking, the primary mode of interaction remains face-to-face or via traditional channels. - Digital Banks

Digital banks excel in accessibility and convenience, offering 24/7 access to banking services through online platforms and mobile apps. Customers can perform transactions, check balances, and access account information anytime, anywhere, through a mobile banking app. The absence of geographical constraints and the ability to conduct banking tasks remotely enhance the overall convenience of digital banking.

Customer Experience and Personalization

- Traditional Banks

Traditional banks may provide personalized services through in-person interactions with bank staff, who can offer tailored advice and assistance based on individual needs. However, the level of personalization may vary depending on factors such as branch location and staff availability. - Digital Banks

Digital banks prioritize customer experience by offering intuitive interfaces, self-service tools, and personalized financial insights. Through data analytics and artificial intelligence, digital banks can provide customized recommendations and proactive support to meet the unique needs of each customer. The seamless digital experience fosters greater engagement and satisfaction among customers.

Technology and Innovation

- Traditional Banks

Traditional banks may incorporate technology into their operations, but they often face challenges in adopting and integrating new technologies due to legacy systems and organizational structures. While some traditional banks invest in digital transformation initiatives, innovation may be slower compared to digital-native counterparts. - Digital Banks

Digital banks leverage advanced technologies such as artificial intelligence, machine learning, and blockchain to deliver innovative banking solutions. They prioritize agility and flexibility, allowing for rapid experimentation and adaptation to emerging trends. Digital banks are at the forefront of fintech innovation, constantly introducing new features and services to enhance the customer experience.

Security and Trust

- Traditional Banks

Traditional banks have established reputations and trust built over decades of operation, which can provide a sense of security for customers. They invest in robust security measures to protect customer data and transactions, often combining physical security measures with digital safeguards. - Digital Banks

Digital banks place a strong emphasis on cybersecurity, implementing sophisticated encryption techniques, multi-factor authentication, and real-time fraud detection systems. While some customers may initially have concerns about the security of online banking, digital banks proactively address these concerns through transparent security practices and regulatory compliance.

Traditional and digital banks offer distinct banking experiences characterized by their approach to branch presence, accessibility, customer experience, technology adoption, and security measures. While traditional banks emphasize physical branch networks and personalized services, digital banks prioritize online accessibility, convenience, and technological innovation. Understanding these differences can help consumers make informed decisions about their banking preferences and needs in an increasingly digital world.

Advantages of Online Banking Services

Statistics on digital banking show that by 2024, global online banking users are projected to surpass 3.6 billion, with the majority of this growth attributed to internet-only banks. These banks, benefiting from lower overhead costs, can offer customers the most competitive deals. Consequently, the future of mobile banking appears promising, driven by the increasing popularity and efficiency of internet-only banking services.

Here are more advantages of digital banking for consumers:

- Convenience: Digital banking allows customers to access their accounts and conduct transactions anytime, anywhere, using their preferred devices. This eliminates the need to visit physical bank branches, saving time and effort.

- Accessibility: With digital banking services available 24/7, customers can manage their finances at their convenience, without being restricted by traditional banking hours or geographical limitations.

- Cost-Effectiveness: Digital banking often reduces or eliminates fees associated with certain transactions or services, such as paper statements or in-branch transactions, leading to potential cost savings for consumers.

- Efficiency: Tasks such as fund transfers, bill payments, and bank account management can be completed quickly and easily through digital platforms, streamlining the banking experience for consumers.

- Personalization: Many digital banking platforms offer personalized financial insights, recommendations, and services tailored to individual preferences and financial goals, enhancing the overall customer experience.

- Security: Digital banking platforms employ robust security measures, such as encryption, multi-factor authentication, and real-time fraud detection, to protect customer data and transactions, ensuring a secure banking environment.

- Innovation: Digital banks often leverage cutting-edge technologies, such as artificial intelligence and machine learning, to introduce innovative products and services that meet evolving consumer needs and preferences.

- Environmental Impact: By reducing the need for paper-based transactions and physical bank branches, digital banking contributes to environmental sustainability by minimizing paper waste and carbon emissions associated with transportation.

- Remote Account Opening: Many digital banks allow customers to open accounts remotely, eliminating the need for in-person visits and paperwork, thereby simplifying the account opening process.

Benefits of Online Banking to Offshore Professionals and Business Owners

Digital banking offers numerous benefits for expatriates and international business owners by providing convenient, accessible, and flexible banking solutions tailored to their unique needs and circumstances. Here's how digital banking can help expats:

- International Account Access: Expats can access their bank accounts from anywhere in the world with an internet connection, eliminating the need to visit physical branches or rely on traditional banking hours. This accessibility ensures that expats can manage their finances seamlessly, regardless of their location or time zone.

- Multi-Currency Accounts: Many digital banking platforms offer multi-currency accounts, allowing expats to hold and transact in multiple currencies within a single account. This feature simplifies international transactions, eliminates currency conversion fees, and helps expats avoid the hassle of maintaining separate accounts in different currencies.

- Low-Cost International Transfers: Digital banks often offer competitive exchange rates and lower fees for international money transfers compared to traditional banks. Expats can send money to family members, pay bills, or transfer funds between their home country and host country accounts more affordably and efficiently using digital banking platforms.

- Remote Account Management: Expats can open and manage bank accounts remotely through digital banking platforms, eliminating the need for in-person visits to brick-and-mortar branches. This convenience is especially beneficial for expats who relocate frequently or have limited access to physical banking facilities in their host countries.

- Secure Online Banking: Digital banking platforms prioritize security measures such as encryption, multi-factor authentication, and real-time fraud detection to protect expats' financial data and transactions. Expats can bank online with confidence, knowing that their sensitive information is safeguarded against unauthorized access or cyber threats.

- Budgeting and Expense Tracking: Many digital banking apps offer built-in budgeting tools and expense-tracking features that help expats manage their finances more effectively. Expats can set spending limits, categorize transactions, and monitor their expenses in real time, enabling better financial planning and decision-making while living abroad.

- Customer Support in Multiple Languages: Some digital banking platforms provide customer support services in multiple languages, catering to the diverse needs of expats from different countries and linguistic backgrounds. Expats can receive assistance with account inquiries, technical issues, or general banking queries in their preferred language, enhancing the overall customer experience.

- Flexible Banking Solutions: Digital banks offer a wide range of banking products and services tailored to expats' needs, including savings accounts, investment options, insurance products, and retirement planning solutions. Expats can choose the banking products that best suit their financial goals and lifestyle preferences, enjoying greater flexibility and control over their finances.

Overall, digital banking offers expatriates a convenient, cost-effective, and secure way to manage their finances while living abroad. Whether it's accessing accounts remotely, transferring money internationally, or tracking expenses, digital banking empowers expats to stay connected to their finances and achieve their financial objectives with ease.

The Future of Digital Banking

Reports on online banking show a significant trend towards digital banking adoption, with 61% of consumers expressing interest in switching to a digital-only bank. Additionally, 35% of consumers currently rely on non-traditional financial services, such as digital-only banks or prepaid accounts, as their primary providers.

As technology continues to evolve and consumer expectations evolve, the future of online and mobile banking holds immense promise and potential. We can expect to see further advancements in areas such as artificial intelligence, data analytics, and mobile banking technologies, enabling banks to offer more personalized and innovative services. Moreover, the rise of open banking initiatives and collaborations with fintech startups are likely to drive greater competition and innovation in the digital banking landscape, ultimately benefiting consumers with more choices and enhanced experiences.

Digital banking represents a fundamental shift in the way we perceive and interact with financial services. Its accessibility, convenience, innovation, and emphasis on security distinguish it from traditional banking models, offering customers a seamless and personalized banking experience.

Suisse Bank - Providing Excellent Digital Banking Services

If you're looking for a digital bank trusted by thousands of people worldwide, then Suisse Bank is the first to consider.

Suisse Bank is an offshore digital banking service provider for expats, CFOs, business owners, and digital nomads. We pride ourselves on providing innovative and flexible financial solutions tailored to the unique needs of our clients. With a rich history and a commitment to excellence, Suisse Bank has established itself as a trusted partner for individuals and businesses seeking efficient and secure banking services worldwide.

- Multi-Currency Accounts: Our personalized multi-currency segregated accounts, held at NatWest, a prestigious Tier 1 bank in the UK, allow you to manage international payments effortlessly. With access to over 50 currencies across 170 nations, you can conduct transactions with ease and confidence.

- All-In-One Wallet: Experience unparalleled convenience with our All-In-One Wallet, featuring a MasterCard-powered debit card and seamless digital asset management. Whether you're a digital nomad or a business owner, our wallet allows you to access funds, make purchases, and manage digital assets with ease.

- Global Trade Support: Suisse Bank offers globally advised bank guarantees and letter of credit services, backed by esteemed financial institutions such as Citibank US. Our trade finance solutions ensure the security of transactions for importers, exporters, and contractors, facilitating smooth and efficient global trade.

- Swift Onboarding and Personalized Support: Get started with Suisse Bank in under 30 minutes, without the hassle of traveling, having a registered business, or being a resident of the UK. Our dedicated team of experts provides around-the-clock assistance and personalized support, guiding you through every step of the banking process.

Experience the convenience, flexibility, and security of offshore digital banking with Suisse Bank. Contact us today to learn more about how we can empower your financial journey.