What are the Top 10 Benefits of Digital Wallets

Digital wallets have transformed the way we manage and make payments. With the increasing use of mobile devices, digital wallet apps have become an essential tool for managing international financial transactions. Whether it’s for online shopping, money transfers, or paying for purchases in-store, the benefits of digital wallets are undeniable. In this article, we will explore the top benefits of digital wallets and how they are changing the way we transact.

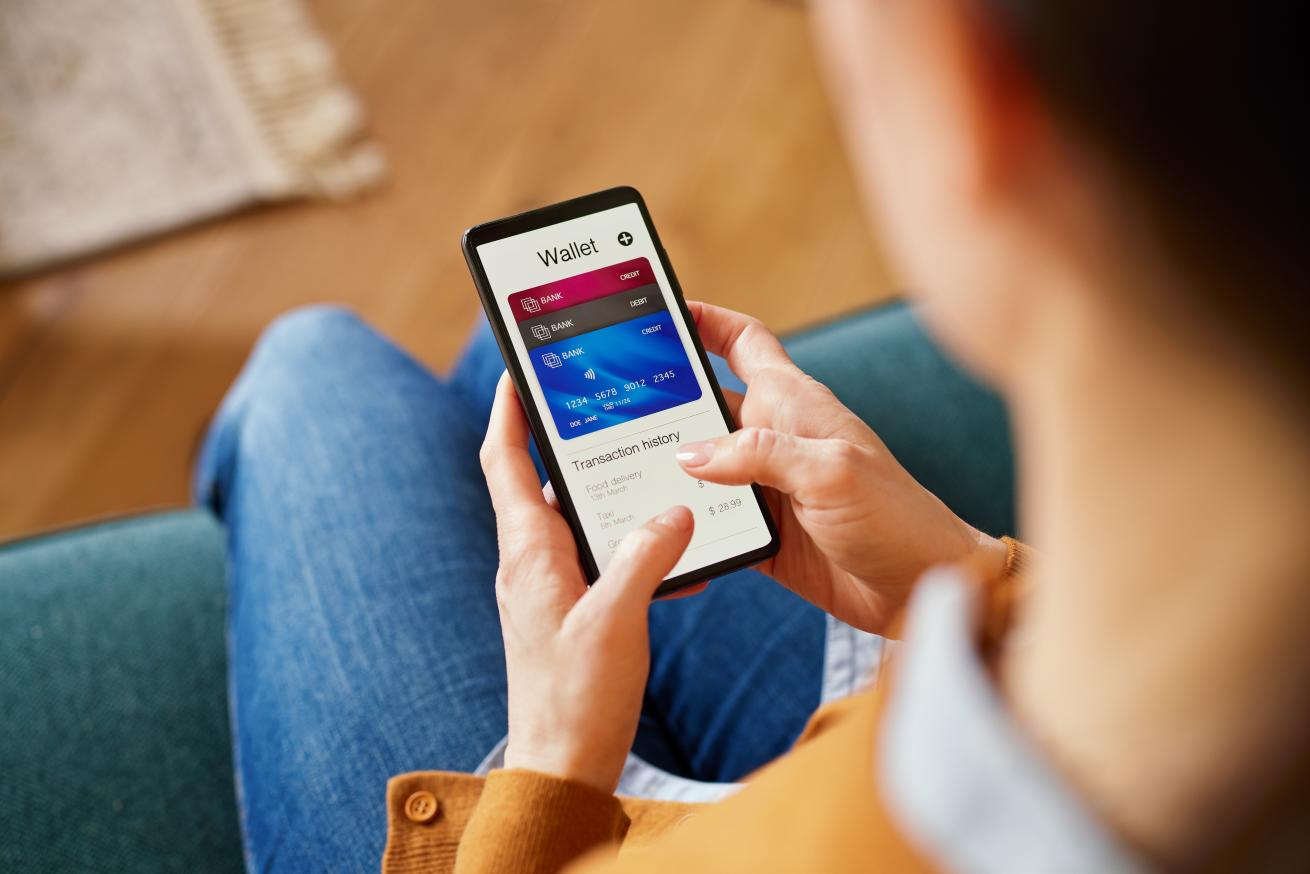

Introduction to Digital Wallets

Digital wallets are an innovative way of managing payments and financial information. These e-wallets store users' payment methods, such as credit and debit card details, bank account information, and even virtual cards. With the rise of mobile wallets on smartphones, digital wallets have become essential for quick transactions, offering a convenient and secure way to make purchases both online and in stores.

Benefits of Digital Wallets

The benefits of digital wallets are wide-ranging, and they offer advantages that can simplify how we handle our finances. These wallets provide a faster, more secure, and convenient way to make payments.

1. Convenience of Using Digital Wallets

Using a digital wallet means you no longer need to carry around a physical wallet filled with credit cards, debit cards, and cash. You can store multiple cards and payment methods within a single app on your mobile device. This eliminates the need to rummage through your wallet to find the right card for your purchases. Whether shopping online or in-store, accessing your payment methods is as simple as opening an app and selecting the right card.

2. Speed and Efficiency in Transactions

Digital wallets allow for quicker transactions, saving you time while shopping or making payments. Instead of inserting your debit or credit card into a payment terminal or manually entering payment details online, you can simply tap your phone to complete the transaction. With contactless payments and near-field communication (NFC) technology, digital wallets offer faster, more efficient transactions that streamline your shopping experience.

3. Ease of Money Transfers with Digital Wallets

Digital wallets are an excellent option for transferring money quickly and securely. Whether you’re sending funds to friends, and family, or paying for services, money transfers through digital wallets are fast and efficient. With a digital wallet app, transferring money becomes as easy as a few taps on your mobile device. Digital wallets offer an affordable way to send funds across the globe, often with fewer transaction fees compared to traditional methods.

4. Access to Multiple Payment Methods

One of the main benefits of digital wallets is the ability to access multiple payment methods in one place. You can store credit cards, debit cards, and even virtual cards within a digital wallet, making it easy to switch between different payment methods based on your needs. This flexibility allows users to manage their finances more effectively, whether for online shopping or making in-store payments.

5. Enhanced Security Features

One of the key benefits of digital wallets is their enhanced security. Traditional methods of payment, such as debit and credit cards, can expose your sensitive data, making them vulnerable to theft. Digital wallets, however, provide additional layers of security through biometric authentication, such as fingerprints or facial recognition, ensuring that only you can access your payment information. This added layer of security makes it harder for unauthorized users to gain access to your financial data.

6. Streamlined Online Shopping

Shopping online has never been easier thanks to digital wallets. With digital wallet apps like Google Pay, you can store all your payment information securely and use it for quick transactions. You no longer need to manually enter your bank account details or credit card numbers when making a purchase, speeding up your online shopping experience. Mobile wallets streamline this process and reduce the hassle of checking out various e-commerce websites.

7. Track Expenses Easily with Digital Wallets

Managing your finances has become simpler with the ability to track expenses through digital wallets. Most digital wallet apps offer features that allow you to categorize and monitor your spending. You can easily track financial transactions, whether they’re debit and credit payments or money transfers, helping you stay on top of your budget. This built-in expense tracking is particularly useful for anyone who wants to maintain better control over their finances.

8. Global Accessibility for International Transactions

Digital wallets are perfect for those who frequently engage in international transactions. With a digital wallet, you can send and receive money globally with ease, eliminating the need for expensive bank transfers or exchange fees. Mobile devices offer seamless access to these payment apps, making it easier than ever to handle cross-border payments efficiently.

9. Split Bills and Manage Shared Expenses

Another great feature of digital wallets is the ability to split bills and manage shared expenses with others. Whether dining with friends or sharing household costs, mobile wallets allow you to easily divide costs and settle payments. This makes it simpler for groups to manage money and avoid the hassle of cash transactions. Payment apps also allow you to receive money from others directly to your wallet with just a few taps.

10. Loyalty Programs and Rewards

Many digital wallets also come with built-in loyalty programs and rewards. You can easily earn points, discounts, and special offers through your digital wallet when shopping at participating stores. These loyalty programs greatly benefit digital wallets by rewarding you for regular purchases. By linking your debit card or credit card to your wallet, you can also earn rewards automatically every time you make a purchase.

Digital Wallet Apps: The Future of Payments

Popular digital wallet apps are making waves in the payments industry. These apps allow you to store your payment methods and even manage bank accounts and credit cards. Digital wallet apps enable faster, more convenient payments, giving users the freedom to make purchases at the touch of a button. Many of these apps also offer features like loyalty programs and discounts, adding extra value to digital wallet usage.

Suisse Bank offers its All-in-One Wallet, which combines multiple financial services into one platform. It allows users to manage multi-currency accounts, transact cryptocurrencies, and make payments securely through apps. With easy access to financial tools, including fast money transfers, the wallet simplifies managing both personal and business finances, providing a versatile solution for digital payments.

How Mobile Phones Are Revolutionizing Digital Wallets

Mobile phones are at the core of the digital wallet revolution. With the rise of mobile wallets, smartphones have become essential tools for managing payment information and making financial transactions. The convenience of carrying your wallet app on your mobile device means you can easily access credit cards, debit cards, and even bank account information in just a few taps. This integration simplifies business transactions, streamlines money transfers, and offers additional security features, such as biometric authentication, making mobile phones the ultimate tool for digital wallet users.

The Future of Digital Wallets

The future of digital wallets is incredibly bright, driven by technological innovations and the evolving needs of consumers. As mobile wallets continue to integrate new payment methods, users can expect even more payment options within a single digital wallet app. These advancements promise faster transaction speeds, improved security features, and biometric authentication methods that further protect payment information and enhance the benefits of digital wallets.

Additionally, digital wallet apps will continue to simplify financial transactions by allowing for money transfers and bill payments to be managed more seamlessly. With the growing reliance on smart devices, digital wallets will integrate further into daily life, offering new ways to make purchases both online and in-store. As more consumers adopt digital wallets, global payments will become even faster and more efficient, increasing the rise of digital wallets as the preferred payment method for managing money and conducting financial transactions.

Why You Should Consider Using Digital Wallets

Digital wallets offer numerous benefits that can make managing your finances more efficient, secure, and convenient. From enhanced security features and quick transactions to the ability to manage multiple payment methods in one app, digital wallets are changing the way we handle money. With the growing adoption of mobile wallets and the increasing acceptance of digital wallet payments in stores and online, now is the perfect time to make the switch from physical wallets to digital wallets.

Explore the benefits of Suisse Bank for businesses and enjoy easy access to multi-currency accounts, trade finance solutions, seamless payments, and secure money transfers. With features for both personal and corporate users, it's a convenient tool for managing finances without the need for business registration. Discover more and start using it today for simplified financial management.